J. C. S. Silva and A. T. d. A. Filho, “Interactively Learning Rough Strategies That Dynamically Satisfy Investor’s Preferences in Multiobjective Index Tracking,” in IEEE Transactions on Evolutionary Computation, doi: 10.1109/TEVC.2023.3321341.

Abstract

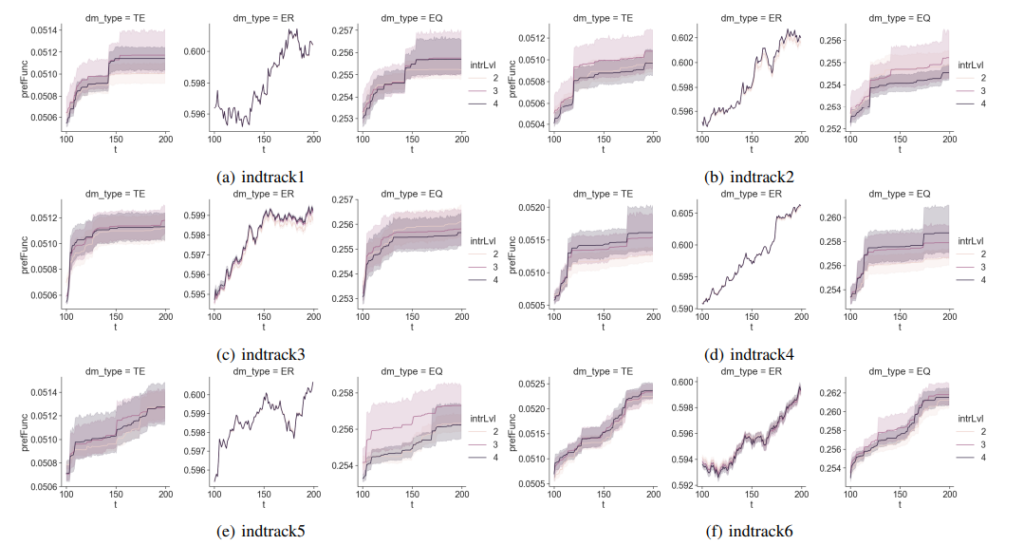

Multiobjective index tracking models optimize portfolios considering investors’ desire to replicate or outperform a market index. It is possible to search for the best portfolio in the optimal Pareto Front for a given investor with Interactive Multiobjective Optimization using Dominance-based Rough Sets Approach (IMO-DRSA). However, obtaining the optimal Pareto front can be impractical as the index size grows. Therefore, evolutionary multiobjective approaches (EMO) can be used to find good fronts in a reasonable time. A simulated IMO-DRSA approach was adopted and extended to offer insights on how to design interactive processes for index tracking considering the stochastic output of EMO. The extended simulated IMO-DRSA approach analyzes how different factors, such as the number of interactions and methods for cognitive effort reduction, affect the capacity of an EMO to produce good portfolios for different types of artificial investors during interactions and to maintain their goodness over time. In contrast to previous studies, this research explores various approaches for displaying potential portfolios to investors and investigates the performance of an evolutionary algorithm guided by IMO-DRSA in multiple problem instances with an increased number of objectives.

Authors

Julio Cezar Soares Silva, Centro de Informática, Universidade Federal de Pernambuco, Recife, Brazil

Adiel Teixeira de Almeida Filho, Centro de Informática, Universidade Federal de Pernambuco, Recife, Brazil

Comentários desativados